A Caution for Real Estate Investors

A note of caution to real estate investors. Real estate taxes are rising.

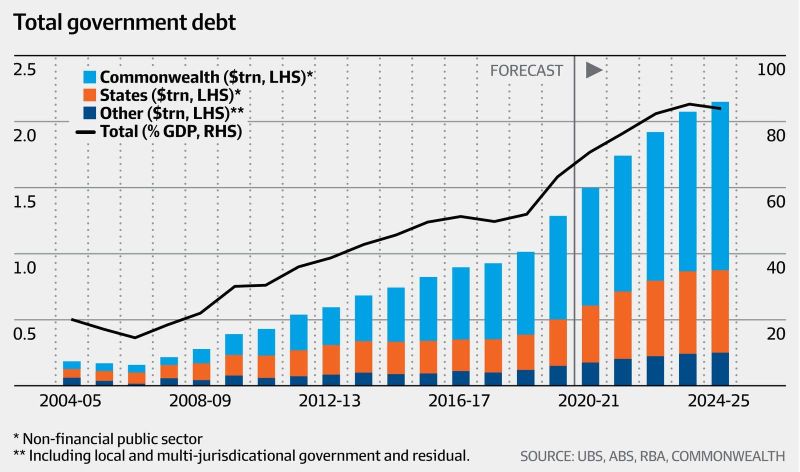

Total debt held by Australian governments will more than double from pre-pandemic levels, to just under $2.0 trillion by June 2023.

That means in the three years from 2020-2023, we will hand over a tax invoice to our children and grandchildren of almost $1.0 trillion.

But who will bear the brunt of this additional tax? Financial markets or real estate markets?

Equity markets are far larger than commercial real estate markets but much more difficult to tax. Capital is highly mobile – so if Australia imposes taxes on stock market investors, they will just shift their investment offshore. In time, Australian companies will also relocate their headquarters offshore.

But real estate is immovable. If you want to play, you’ll have to pay. That’s why it’s always been the easier target.

So expect higher stamp duty, higher land taxes, higher capital gains taxes on investment properties – as well as mounting pressure to remove the capital gains tax exemption for principal residences (especially for “luxury houses” above say $2.0 million).

Higher taxes are coming our way and it will impact future returns. Prepare for a “lower growth / lower returns” world for the next decade or so.